Welcome to this post, where we are going to see the best strategies to make staking with your Matic and get the best profitability with your cryptocurrencies.

We are going to cover the main and most used strategies with Matic to get a good performance with your cryptocurrencies. We will focus on the safest and most used platform strategies, and not so much on smaller platforms that can give a higher return, but also have much more risk.

Also, mention that the returns we are going to see, will probably vary and be somewhat different when you are reading this. Since in DEFI, the annual % usually vary a lot in a short time, so don’t be surprised. Still, you can use this guide as a reference to see which platforms are better and offer a better annual %. Even if it is not the same annual %, it is very likely that the platforms that offer the best annual % are still the same.

If you want to know on your own all the possibilities there are and platforms on your own, I have created a guide detailing the tools and aspects you should consider to find the best staking and farming opportunities for any cryptocurrency, which you can find here. So you can’t miss this guide if you want to be updated on the best opportunities.

Best place to Stake Polygon/Matic

We will cover two different types of strategies. The first part will include staking and strategies involving only one token, in this case Polygon (MATIC). And the second part, we will focus on LP Tokens with Matic that have no risk of impermanent loss, and therefore, the risk is the same as staking or single token strategies.

The main difference is the complexity it may have for newer users who have never created an LP Token or done farming with them. Therefore, we will cover this type of strategies later on, starting with the simplest strategies. Even so, it is worth mentioning that these strategies with LP Tokens usually offer better profitability. So, many times it is worth using them instead of the first ones we will see.

Still, you need to have some knowledge about LP Tokens and the risk of impermament loss before applying these strategies. If you are new to DEFI or farming, you can find guides on our site to help you understand the more complex strategies we will be looking at. With that said, it’s time to get started.

Staking

Lido

The first option we will look at is Lido, with Matic’s liquid staking with stMATIC. Lido has become the leading liquid staking platform with cryptocurrencies like Ethereum, Luna and Solana, and recently they have recently started offering this option with MATIC.

On Lido you can get 8.67% APY at the moment, plus the extra % you can get using your stMATICs on other DEFI platforms. This is possibly one of the most profitable options at the moment.

Although we have already covered it in other guides, liquid staking, as its name indicates, is staking where you receive a token as a guarantee of the MATIC you deposit. This token, which in this case is stMATIC, appreciates in value with respect to MATIC the annual % that it shows, in this case, 8.67%. The best part is that when you staking, you deposit your tokens and you cannot use them.

With liquid staking, as you have in your stMATIC wallet, you can use this token while earning the annual % we have discussed. stMATIC you can use it on lending platforms to deposit and earn an annual %, or create an LP to get an extra annual % as we will see later. These are the main uses, but there are more options and in the future we will see more and more alternatives where to use our liquid staking tokens.

Note that to convert your stmatic to matic again, you will have to wait 9 days going to withdraw. Although you can exchange your stmatic to matic in any DEX like quickswap, although you will not receive the same amount as in Lido, you will not have to wait the 9 days, and usually the difference is between 1-2% of the total.

You can find the Lido guide in more detail here.

Aave and Venus

AAVE and Venus are two lending platforms. And although in these platforms you will not do staking, the idea to get an annual % using your Matic is very similar. Basically, you deposit your MATIC in exchange for an annual %, and users who want to borrow, will use your Matic and in return you will receive the annual % it shows. So, it is not the same as staking, but it shares some similarities. Where you deposit your Matic, and in return you receive an annual % as a reward.

You can look at more lending platforms on Polygon or other networks that you can deposit Matic, but AAVE is the main one with 1.14% APY at the moment.

In the case of Venus, we have 3.04% per annum. But note that Venus is on the Binance Smart Chain, so you will have to move your Matic from the Polygon network to the BSC to use Venus.

Usually lending platforms usually give a lower % than staking, but on the other hand, you can use it if you want to borrow some other cryptocurrency and use MATIC as collateral. Or sometimes where there are incentives, it is possible that some lending platform offers better annual % than staking, as we saw with Matic some time ago.

You can find the AAVE guide in more detail here.

You can find the Venus guide in more detail here.

Bancor

Bancor is a platform where you can deposit a single token in an LP Token and thus avoid the risk of impermanent loss, being very similar to staking. With the difference that you are providing liquidity on a platform like LP, only depositing a part of that LP. In the case of MATIC and most of them, they are LPs with the Bancor token, BNT.

In this case, with MATIC you can get 1.52% APR using Bancor. Although you have to keep in mind that there are limits, as you have to be compensated the amount of Matic with BNT. Although with the annual % at the moment, there is plenty of room to deposit your Matic in Bancor.

Although at the moment Matic’s annual % is not very competitive, it is another platform that could offer a good return in the future, if there are incentives or it is used more to exchange Matic. At the moment, it does not offer a very interesting %.

You can find the Bancor guide in more detail here.

Stader

Stader is a platform that we covered in Terra’s staking guide, and we didn’t think we could find it here. But this platform has been expanding to other networks and liquid staking opportunities, beyond Luna.

At the moment, it offers liquid staking also from Hedera, and as you can imagine, from Matic. Entering in competition with Lido, being the second option of Matic with liquid staking.

In this case, Stader will receive the MatixX token, with 8.53% APY. A little less than the % you got in Lido with 8.67%, but what is really interesting is to see which of the two will have more uses and you can get a better performance with the liquid staking.

Both platforms are quite safe as they have other liquid staking options that have not had any problems. But Lido is better known and has more capital invested in it, among all the liquid staking options it offers. In the case of MaticX, for the moment it can only be used in Quickswap with an LP that we will see later, very interesting.

Soon, as you can see in its DEFI tab, you will be able to use your MaticX in Balancer, qidao, market and beefy finance or autofarm. So, if MaticX has more utilities on different platforms than stMatic, it could be a better option, even if it has a little less annual return.

You can find the Stader guide in more detail here.

Acryptos

Acryptos is a farm optimizer that uses different strategies to achieve the best possible performance. The platform is located in the binance Smart chain, but even so, it has a vault where you can deposit your MATIC and get a good annual return.

In this case, the Matic vault and strategy, uses the Venus platform that we have seen before. In this case, right now it is giving 8.03% APY. And the difference to get that annual % compared to the 3.04% that we have seen with Venus, is to use leverage to put Matic back in and increase the annual %. Plus the incentives you get for using Acryptos.

Although this platform offers a good annual %, it is important to note that it is somewhat new and is in Beta. Therefore, it has more risk than other platforms that have been in DEFI for a longer period of time. Even so, it can be a good option if you take into account the extra risk it may have with respect to other platforms.

Centralized Exchanges

Finally, there are centralized platforms such as exchanges that offer staking options to users. Platforms such as Binance, Kucoin, gate.io, coinbase, crypto.com, kraken and many others.

In this case, we will look at two of the platforms that I personally use and have Matic staking options. If you use other platforms, you can look to see if Matic is staked, and if not, use the platforms we will now look at.

The first one is Binance, being the #1 Exchange in the world, and with good returns. With 10.24% in 30 days, and 21.54% in 90 days of blocked staking. As its name indicates, blocked staking means that you cannot use the Matic that you have and if you want to withdraw them before the time, you will not receive the rewards. In addition, in most occasions that offer a very high %, as they are 90 days, there is usually a limit of Matic that you can place per user, and it is usually quite low when the annual % is so high in comparison.

The other option is flexible staking, where you can withdraw or use your Matic tokens whenever you want without having to block them with a 6% annual fee. Although there is quite a difference in annual %, it already depends on whether you are interested in blocking your tokens for a while or not.

The other platform is KuCoin, which offers 4.14% p.a. in flexible staking. Being lower than Binance, but another option if you use this Exchange.

In general and from what I have seen, Binance usually offers the best annual % in staking compared to other exchanges. Even so, I recommend you to look at the main exchanges if you want to see which one offers the best performance. Although keep in mind that these % vary, and sometimes, some exchanges offer a very high annual % to attract users and then it is not so competitive.

If you don’t have an account with binance or kucoin, you can create one just below to start staking.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

Platform: KuCoin

Min. Deposit: $30

License: Cysec

Very low commissions

Exchange with a wide variety of cryptocurrencies

LP Tokens without impermanent loss

Now that we have seen all the staking and similar options, let’s look at the more advanced strategies that use stmatic and maticX as LP Token with Matic for better performance. Since many times these LP Tokens in farming offer a better performance than just staking with your Matic, and there is no or very little risk of impermanent loss.

We will see the LP tokens stmatic-matic and maticx-matic, that being tokens with the same price, taking into account that stmatic and maticx appreciate with respect to matic, the risk of impermanent loss is almost none. In addition, by having 50% in stmatic or maticx, you will be generating an annual % as well, which compensates the small risk that you may suffer by impermanent loss when these tokens appreciate with respect to matic.

In the end, it ends up being very similar to staking, but with the difference of creating an LP Token and farming. And a little more risk, and stmatic or maticx are disengaged from the price of Matic by some failure. Although it is very unlikely to happen, and it is a risk you also have if you use MaticX or stMatic. But it can be a bit tricky for users newer to DEFI. But it’s worth understanding, for the difference in annual % you can get, as we will now see.

Quickswap

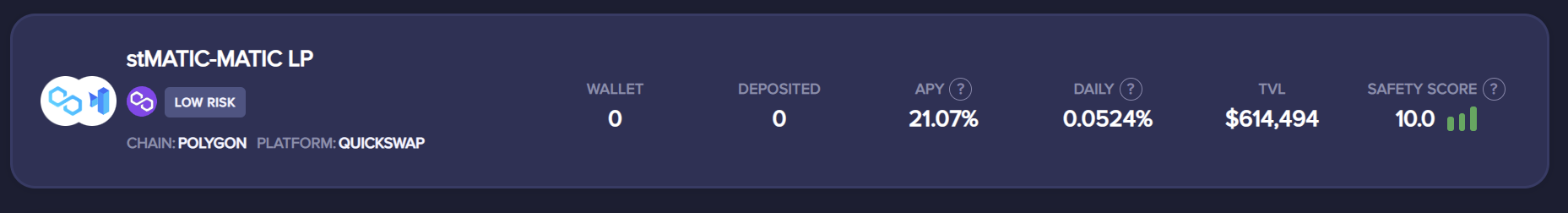

The main platform where we find these two LP Tokens is on Polygon’s main DEX, Quickswap. Here, we can find both stmatic-matic and maticx-matic LP and provide liquidity to get a good annual %.

In this case, stmatic-matic is currently yielding 23.73% APY, and maticx-matic is yielding 44.69% APY. Although the latter, it is very likely that over time it will get closer to the 20-25% that stmatic-matic offers. Being a newer LP Token and with little liquidity at the moment, it has a very high annual %.

Still, as you can see, you are getting more than 20% per year, compared to the 8-9% per year we have seen in staking previously. In addition, of the 50% of your LP, which are stmatic or maticX, you are appreciating in value the approx. 8.50% we have seen above. Which makes it much more profitable than we have seen before.

MaticX-Matic’s LP offers better annual %, and will likely stay that way for a while, as it has a bit more risk, stader being a newer and less capital intensive platform than Lido. What makes some users prefer to use stmatic-matic instead of maticx-matic for the lower risk it has, and therefore Maticx-matic, will have more annual % return.

You can find the Quickswap guide in more detail here.

Balancer

Another platform where we find wmatic-stmatic LP is on Balancer. But here, at the moment they are only giving 0.05% apr, since the users of the Polygon network use Quickswap to exchange and not Balance. The LP tokens, get the annual % of the exchanges that users make, and as balancer is very little used in polygon, makes the annual % so low.

Even so, they may use it more in the future or increase the annual % they are giving as an incentive to attract more users. It is another option to keep in mind and look at.

You can find the Balancer guide in more detail here.

Beefy

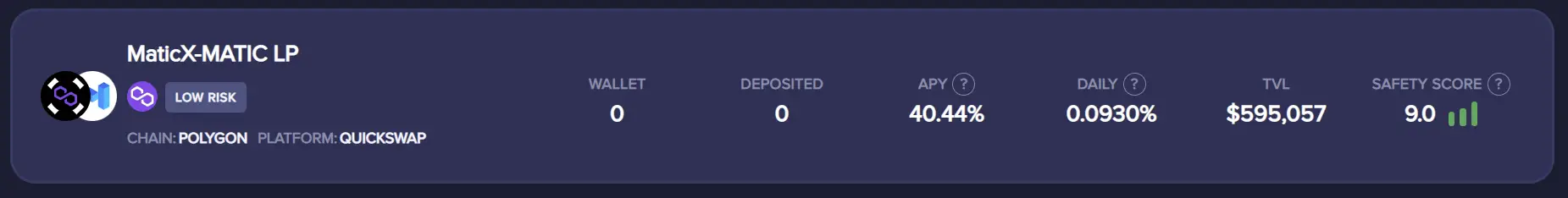

Finally, we find Beefy Finance, a farming optimizer, where we can maximize our farming with Quickswap LP Tokens, both with stmatic-matic and maticx-matic.

At the moment, we can achieve 21.07% APY with stmatic-matic, and 40.44% APY with maticx-matic. Although the % are lower than the ones we have seen, sometimes it is because it is not updated correctly, and almost always, the real annual % you get with Beefy finance or any optimizer, is higher than the one you get using quickswap directly.

In addition, in quickswap as a reward you get the native token of the Quick platform, and in Beefy, you get more LP Tokens. Which makes it have an added value, since Quick is a very inflationary token and is likely to fall in price, while with Beefy you will get more LP Tokens, and therefore more Matic. So, while the profitability may be somewhat lower or the same, using Beefy has this added advantage.

Although it is also important to note that using Beefy has an added risk, as you are using another platform besides quickswap. So the risk of hacking or smart contracts is both quickswap and beefy. Unlike if you use quickswap directly with your LP tokens. Although beefy is one of the most secure and longest running optimizers in DEFI, it is another risk to consider.

You can find Beefy Finance’s guide in more detail here.

If you have made it this far, congratulations. Finally, I would like to mention that these are the main strategies at the moment, but in DEFI everything changes very fast and it is possible that new interesting platforms will appear in the future. So I recommend you to use this guide as a reference, but also to see what other platforms are used in polygon to see if there are better opportunities at the moment.

Actually every few months, it is possible that new interesting opportunities may appear where you can use your Matic and get a good return for it. As it has happened in the past, before for example Lido with stMatic or Stader with MaticX.

I hope this guide has helped you to know the main platforms and strategies for staking your Polygon (Matic) and to be able to get a good profitability with your tokens. If you want you can find here the guide to find the best staking and farming opportunities. Remember, if you don’t have an account with Binance or KuCoin, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies

Platform: KuCoin

Min. Deposit: $30

License: Cysec

Very low commissions

Exchange with a wide variety of cryptocurrencies