Welcome to this post, where we are going to see how Yield Yak works and everything you should know about this platform.

We are going to see how one of the main platforms in the Avalanche network works and how it works, so you can understand everything about this platform and how it works.

We will cover the most basic and relevant aspects, and we will not focus so much on other aspects that are not so used or we will go over them in a less detailed way.

What is Yield Yak

Yield yak is a farming and staking optimizer. Very similar to other platforms such as beefy finance, autofarm, spectrum protocol and many others. Although yield yak is the most popular and most used optimizer in the Avalanche network, due to the great variety of opportunities that it offers and that are not found in other optimizers.

An optimizer is in charge of maximizing the annual % that you can get when farming or staking your cryptocurrencies in other platforms, as it could be in the Exchange Trader Joe. They do this by solving the inefficiencies that these platforms have, where when you do farming or staking you get rewards for it every so often.

The optimizers use the rewards you receive to exchange it for the cryptocurrency or cryptocurrencies you are farming or staking and put these cryptocurrencies back into the farm. This is known as compound interest, by using the rewards and reinvesting them in the farm or staking to increase the amount you have invested. And so you get a higher annual %. This is the difference between APR and APY, where apr is without using the rewards and reinvesting them, and APY is reinvesting the rewards you get back into the farm or staking.

Although it can be done manually, using the rewards and putting them back into the farm is usually not very efficient and if it is a small amount, the gas fee you have to pay to make the transactions may be higher than the profit you get. Therefore, platforms such as yield yak that do it with large capitals, make it much more efficient.

If you go to for example trader joe and look for an LP token, you can see the annual % you get and see that on yield yak, most of the time you are going to get a higher annual %. That’s why many people use yield yak, instead of going directly to trader joe or the platform where you do farming or staking.

At this time, yield yak has over $200 million in LTV or total locked value within their platform.

Swap

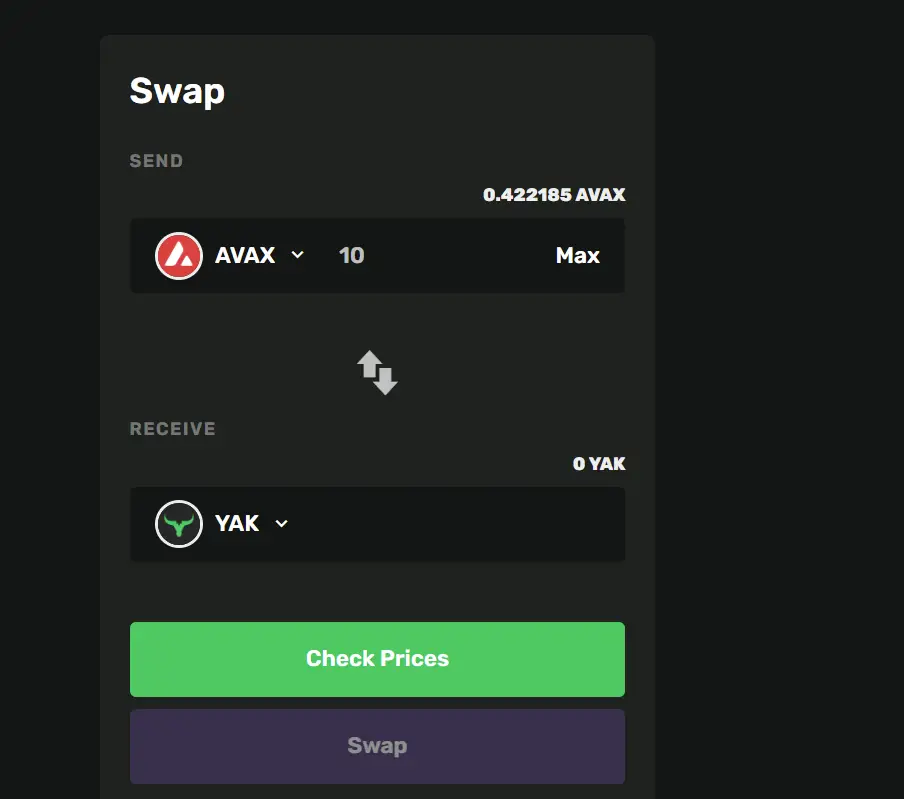

The first thing we find is a swap. We will not go into detail, as it works like any other usual swap you can find.

It is useful if you are in yield yak and you see some interesting farm or staking option, and you can directly exchange your cryptocurrencies here instead of going to another DEX. But it is not the main part of this platform. Even so, it can be useful to exchange cryptocurrencies that are in yield yak and you want to do farming or staking with them in the platform.

Farms

In farms we find the main and most interesting part. Here, we find what is known as vaults, that each vault is a strategy where you will deposit and you can see all the information. For example, the usdc-avax vault that trader joe uses.

What I recommend is that you use the filters above to find the farms you are interested in more easily, as there is a great variety. If you don’t have any specific idea, you can simply look at which ones seem more interesting to you. The filters are very useful as you can filter by different platforms, most popular, most annual % and different types of farms, single token, stablecoin or LP Tokens among many other filters.

Really the filters are very useful to see what opportunities yield yak has in different categories as it could be in stablecoins and not having to search for it among all the vaults. You can also use the search engine if you are looking for a specific cryptocurrency such as AVAX.

In each vault before clicking on it you can see the cryptocurrency or LP Token it is, under which platform it uses, the annual % you get in APY, and the amount invested in that vault in TVL. For example, with USDC-AVAX, we see that it is from trader joe, with a TVL of 7.27 Million and 30.34% APY.

Once you have seen a vault you are interested in and click on it, you can find more information inside. If we go down, we find strategy, where he explains what kind of strategy he uses to get that annual %, and we can even see the transactions of that strategy to check that he really says what he does. Further down in yield, you can find more detail on the recent annual %, how long it has been doing auto compounding of rewards, and the frequency of times it does compound interest. Next to it, you will see a graph of the growth of the position you have deposited in that vault. Since you don’t get rewards, and it does compound interest, every time you will have more and more cryptocurrencies or LP Tokens than you have deposited in that vault. And in that graph you can see the growth it has had.

With all this information about each vault, the only thing left to do is to deposit if you are interested in using it. To do this, go to the top and deposit the cryptocurrency or LP Tokens you are interested in. Note that if they are LP Tokens, you must go to the platform to create them and you cannot come from another DEX or platform. For example, if you want to do farming with USDC-AVAX in trader joe’s vault, you must create the LP Tokens in trader joe. Because if you create the LP Tokens in for example pangolin, another DEX, you will not be able to deposit them.

With the tokens in your wallet, indicate the amount, click on deposit and confirm in your wallet. To withdraw your tokens, simply go to withdraw, enter the amount and confirm the transaction in your wallet. You will have your tokens back in your wallet.

Finally, there is a reinvest button. The reinvest button takes all outstanding rewards from a pool, converts them into the farm asset and reinvests it back into the vault to make up the deposits for the entire vault.

There is a variable reward to incentivize users to press the button. Whoever is the first to press the button gets the reward and makes up everyone’s deposits.

Stake

In stake you will be able to staking the native token of the platform, YAK, at the moment with a 20% annual reward for staking. In ARC you can see the rewards that are distributed to users staking YAK. These rewards are part of the commissions that the commission gets from the vault.

The commissions in the Yak Fee Collector contract can be distributed by anyone using Yak ARC. Yak ARC automatically converts and distributes the commissions to the assigned beneficiaries. Where 70% is distributed to staking users, 15% to the yak yield treasury and 15% to contributors. The rewards are received in WAVAX, the wrapped AVAX, a very positive aspect as it is the main currency of the network.

yyJOE and yyPTP

With the appearance of tokens such as veJOE and vePTP, which allow you to increase the annual % you get when farming in trader joe (with veJOE) and platyplus (with vePTP), yield yak has added this type of strategies to its platform with yyJOE and yyPTP.

The operation is very similar to that of the platforms themselves, where you deposit your JOE, and receive yyJOE in a 1:1 ratio. With the yyJOE or yyPTP you can place them in staking within yak yield, and thus be able to receive the bonus in the boosted farms that you can find below.

By exchanging your JOE for yyJOE, you will have access to these higher annual % on farms such as usdc-avax, weth-avax, usdt-avax and many others. The same goes for yyPTP and the farms that are available on this platform. It is a way to be able to use an optimizer with the new functionalities of farms boosted directly with yield yak.

Before finishing, it is worth mentioning that this kind of platforms, such as optimizers, have an extra risk than using the platform directly. Although you also get a higher annual %. The risk exta is if the platform is hacked or has some failure in the Smart contract. Although this does not usually happen and has not happened in yield yak, we have seen an optimizer on the Fantom network that had this problem.

So, although it is a small risk, it is something to consider. Because, if you use trader joe, you have the risk of this platform, but if you use a yield yak vault in trader joe, now you have the risk of two platforms, which can be hacked or have some bug in the Smart contracts. So always take into account this risk before evaluating if it is worth using yield yak or another optimizer, or use directly the farm or staking platform, and what difference in annual % you get.

I hope this guide has helped you to know in more detail how yield yak, Avalanche’s main optimizer, works. Remember that if you don’t have an account with binance, you can create one just below.

Platform: Binance

Min. deposit: $10

License: Cysec

Very low commissions

Exchange with more cryptocurrencies